November 2021

Barbara O’Neill, Ph.D., CFP®

Distinguished Professor and Extension Financial Management Specialist Emeritus

Rutgers Cooperative Extension

One of the best small financial planning steps that everyone can take to improve their finances is to set financial goals. When you set short-term (up to 3 years), intermediate-term (3 to 10 years), and long-term (over 10 years) financial goals, you can calculate how much money you need to save to achieve them.

Short-term goals take less time to reach than long-term goals which may take many years. Building an emergency savings fund may be a short-term goal and having money saved for retirement would be a long-term goal. Every person has different financial goals and different time frames for achieving them.

Do you have a goal or is it a dream? A dream is vague like “I want to send my child to a good college,” or “I want to be comfortable in retirement.” These are dreams. Goals have a clearly defined objective and a deadline date. Many financial educators use the acronym SMART to describe well-written goals , with the letters standing for Specific, Measurable, Achievable, Realistic, and Time-related.

Here are three examples of SMART goals:

- “By the year 2023, we will save $20,000 for the down payment on a townhouse”

- “By the time my child is 18, I will have $40,000 in savings to pay part of her college tuition.”

- “In ten years, I will have $50,000 saved in my 401(k) retirement plan.”

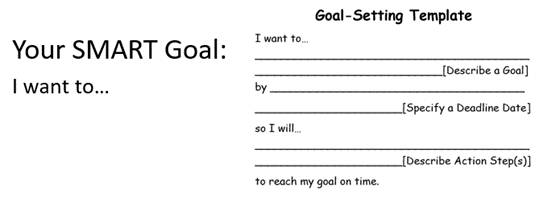

How do you write a SMART financial goal? Start by answering the questions who, what, when, where, and why. Since this is YOUR goal, begin your goal statement with “I/We.” State exactly what you want to accomplish and include a target deadline date in your goal statement.

Then, state exactly what you will do to achieve it and how (e.g., save 6% of pay annually in a 401(k) plan). Keep re-writing your goals until they are specific and achievable. Tell other people about your goals so that there are people to hold you accountable. Track your progress and, if necessary, make changes to your goals as personal circumstances or economic conditions change. Use the template below to get started.

Goals provide a framework for investment decisions and help narrow down your choices. For example, if you have a short-term goal, like a new car purchase in three years, you’ll want to keep this money liquid so that there’s no loss of principal. Equity investments like stock or growth funds would be a poor choice due to the historical volatility of the stock market in short time frames. On the other hand, if you have a long-term goal, like retirement in 2050, cash assets are a poor choice due to the risk of loss of purchasing power.

Bottom Line: Determine your financial goals before you invest money and know what you’re investing for. Having a clearly-defined goal provides motivation to set money aside. A key to investment success is goal-setting. Remember, people don’t plan to fail, they fail to plan…and set financial goals.